What Are the 2026 Federal Income Tax Brackets in Canada?

The Canada Revenue Agency (CRA) has released the 2026 federal income tax brackets. These updated rates apply to income earned during the 2026 tax year. Canadians will file returns for this income in early 2027.

Canada uses a progressive tax system. This system taxes higher income at higher rates. The CRA divides taxable income into five brackets. Each bracket has its own tax rate.

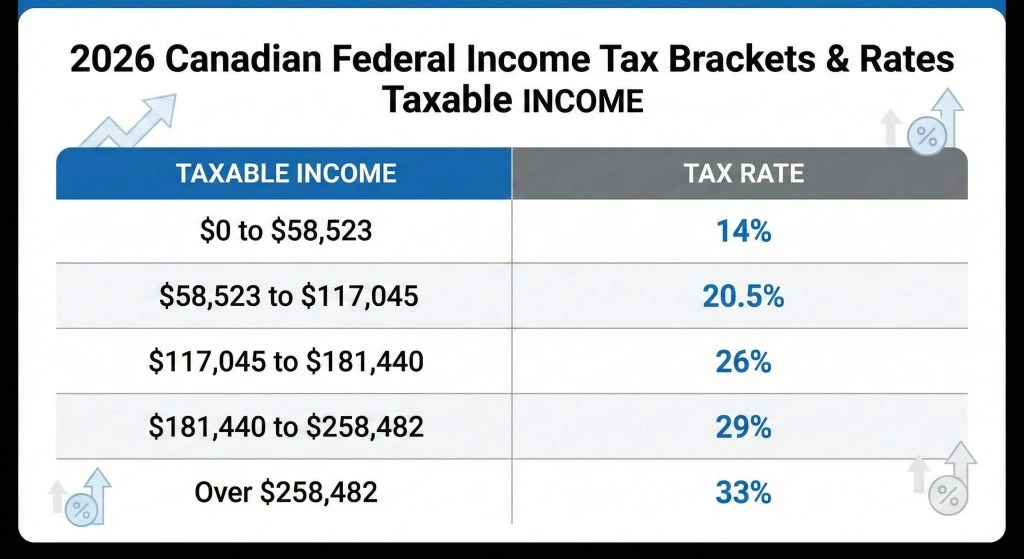

2026 Federal Tax Brackets and Rates

Here are the federal income tax brackets for 2026:

| Taxable Income | Tax Rate |

|---|---|

| $0 to $58,523 | 14% |

| $58,523 to $117,045 | 20.5% |

| $117,045 to $181,440 | 26% |

| $181,440 to $258,482 | 29% |

| Over $258,482 | 33% |

These rates apply only to federal taxes. Each province and territory adds its own tax rates on top of federal taxes.

Key Changes for 2026

The 2026 tax year brings several important updates that affect Canadian taxpayers.

Lower Starting Tax Rate

The lowest federal tax rate drops to 14% for 2026. This rate applies to the first $58,523 of taxable income. In 2025, the rate was 14.5% due to a mid-year change. The full 14% rate now applies for the entire 2026 tax year.

This change reduces taxes for every Canadian taxpayer. A person earning $50,000 will pay approximately $250 less in federal taxes compared to 2024 rates.

Inflation Adjustment

The CRA adjusts tax brackets each year based on the Consumer Price Index. For 2026, the indexation rate is 2.0%. This adjustment increases all income thresholds slightly.

Inflation adjustment prevents “bracket creep.” Without this adjustment, inflation would push taxpayers into higher brackets even when their purchasing power stays the same.

Updated Basic Personal Amount

The Basic Personal Amount (BPA) is a non-refundable tax credit. It reduces the amount of federal income tax you pay. For 2026, the maximum BPA is $16,452.

Canadians who earn $16,452 or less in 2026 will owe no federal income tax. The BPA credit offsets their entire tax liability.

The full BPA applies to individuals with net income of $181,440 or less. For those earning between $181,440 and $258,482, the BPA gradually decreases. Canadians with income above $258,482 receive a reduced BPA of $14,829.

How Progressive Taxation Works

Many Canadians misunderstand how tax brackets work. You do not pay your highest tax rate on all your income. Instead, each portion of income gets taxed at its corresponding rate.

Example Calculation

Consider a Canadian with $100,000 in taxable income for 2026:

- First $58,523 is taxed at 14% = $8,193.22

- Remaining $41,477 ($100,000 – $58,523) is taxed at 20.5% = $8,502.79

- Total federal tax = $16,696.01

After applying the BPA credit of $2,303.28 (14% of $16,452), the net federal tax payable becomes approximately $14,392.73.

Provincial Taxes Add to Your Total

Federal tax brackets tell only part of the story. Every province and territory has separate income tax rates. Your total tax bill combines federal and provincial amounts.

Provincial tax rates vary widely across Canada. A person living in Alberta pays different total taxes than someone in Quebec, even with identical incomes. Check your province’s tax rates for accurate planning.

Tax Planning Strategies for 2026

Understanding the 2026 brackets helps you make smart financial decisions.

RRSP Contributions

Contributing to a Registered Retirement Savings Plan (RRSP) reduces your taxable income. Lower taxable income may keep you in a lower tax bracket. RRSP contributions provide immediate tax savings while building retirement funds.

Timing Income and Deductions

If you expect a year-end bonus, consider how it affects your tax bracket. You may benefit from deferring income to January 2027 if it pushes you into a higher bracket in 2026.

Use Available Tax Credits

Review all federal and provincial tax credits. Credits for charitable donations, medical expenses, and education directly reduce your tax payable. Many Canadians miss eligible credits each year.

Filing Deadline for 2026 Taxes

Canadians must file their 2026 income tax returns by April 30, 2027. Self-employed individuals have until June 15, 2027, to file. However, any taxes owing are still due by April 30, 2027.

Summary

Canada’s 2026 federal income tax brackets feature a lower 14% starting rate and inflation-adjusted thresholds. The Basic Personal Amount increases to $16,452 for most taxpayers. These changes reduce federal taxes for millions of Canadians.

Review your expected income for 2026. Consider how the updated brackets affect your tax situation. Strategic planning around RRSP contributions and available credits can further reduce your tax burden.

Provincial taxes apply in addition to these federal rates. Calculate both federal and provincial taxes for an accurate picture of your total 2026 tax liability.